FUND MORE LOANS WITH ICS

Originate Commercial, Multifamily & Investment Real Estate Loans Nationwide

BECOME AN ICS LENDING PARTNER

INSTITUTIONAL, PRIVATE & HARD MONEY DIRECT LENDING

10,000+

Lenders

3,500+

FDIC Banks

49 STATES

No Nevada

1,000+

Brokers

&

Growing

WE ARE YOUR LENDING PARTNER

Attain the most competitive commercial, multifamily, and investment property rates and terms available in today's marketplace, right here at ICS. With ICS, you can originate commercial, multifamily, and investment property loans at the institutional and private level. We not only provide Loan Brokers with more loan products than any single lender, ICS also provides optional commercial mortgage broker training online, as well as lead marketing services.

MORE LOAN PROGRAMS = MORE OPTIONS

Fund loans at the Institutional & Private Level

Through ICS you can offer more commercial, multifamily, and investment property loan products than any single lender in the country. ICS originates loans which we fund directly, assign, syndicate, or broker through our expansive network of capital partners, including hundreds of banks, credit unions, Fannie Mae, Freddie Mac, and FHA lenders, SBA, life companies, CMBS, as well as private bridge and construction lenders. ICS is your one-stop commercial, multifamily, and investment property lending partner providing access to the most competitive rates and terms available in today's capital marketplace.

ICS is a Correspondent Commercial Mortgage Lending Company offering hundreds of loan products through one single point of contact.

ICS LENDING PARTNER DEMO VIDEO

See Our Platform in Action

Watch our Demo video to see how you can search loans products, submit loans, and access the ICS Funding Platform and loan processing and underwriting services as an ICS Lending Partner.

HOW COMMISSIONS WORK

Earn 20% to 100% of your origination points

Brokers can sign up as ICS Lending Partners, earning 100% of their total origination points charged to the Borrower. Brokers that prefer NOT to sign up can submit loans to ICS for funding, earning 20% of the total origination points.

WHY ICS?

Nationwide Lending

Nationwide Lending

Institutional Loans

Institutional Loans

Loan Processing

Loan Processing

Hundreds of Programs

Hundreds of Programs

Private Loans

Private Loans

Dedicated Loan Team

Dedicated Loan Team

Direct Lending

Direct Lending

In-House Underwriting

In-House Underwriting

Online Training Available

Online Training Available

WEEKLY ZOOM MEETINGS

ICS holds weekly Zoom meetings you can join Monday thru Thursday at 10am PST. These are great group meetings to discuss deals you are working on, loan products, and general FAQ.

MORE LENDERS = MORE OPTIONS

10,000+

Lenders

ICS originates loans which are sold, assigned, syndicated, and brokered to thousands of Lenders on a national level, including Banks, Credit Unions, CMBS, Life Companies, Fannie Mae, Freddie Mac, FHA, SBA, REIT's, as well as Private Lenders for loans that don't meet institutional guidelines.

FULL-SERVICE

LOAN UNDERWRITING

PROCESSING & PLACEMENT

You originate the loans. We structure, process, underwrite, place, and negotiate the best deal with our most competitive lender for you. ICS charges the Borrower a loan processing and underwriting fee starting at $2,500 + 0.5% to 1% of the loan amount, which is usually paid by the funding lender.

LEVERAGE THE POWER

OF THE ICS

FUNDING PLATFORM

FUNDING PLATFORM

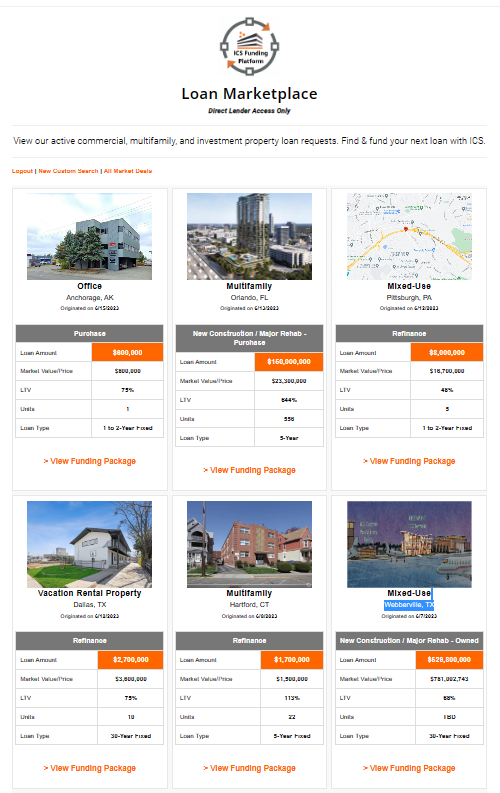

We don't compete with Lenders. We make Lenders compete against each other to fund your loans.

Through the ICS Funding Platform your ICS Loan Team will structure, underwrite, price, package, and submit loans to our network of institutional and private Lenders for you. Interested Lenders will compete for your loans, offering their best rate and terms.

WHO WORKS WITH ICS?

Realtors

Residential Loan Officers

Independent Loan Brokers

Direct Lenders

Bankers

Financial Planners

Accountants

Sales Professionals

Marketing Specialists

STOP REFERRING DEALS & START CLOSING DEALS WITH ICS

Brokers Protected

ICS will NEVER contact your client without your approval.

When you submit a loan for funding to ICS you and your client are protected. ICS does not contact your client and you are guaranteed to earn 100% of your origination points charged to the borrower. A Letter of Interest and Funding Fee Agreement will be issued to you and your client by ICS outlining all fees and the commission to be paid to you upon successfully closing the loan.

Broker Lending Partner Sign Up

Get access to all our loan products, LOS, full-service loan processing, underwriting, and much more. You can refer loans to ICS or sign up as an ICS Lending Partner.

Need Commercial Broker Training?

If you are new to Commercial Mortgage Brokering ICS offers an excellent online training program including live weekly training webinars and one-on-one Senior Broker support. Our training program is optional but highly recommended for newer Brokers. Check out our program.