THE ULTIMATE FUNDING PLATFORM

Got Loans that need FUNDING?

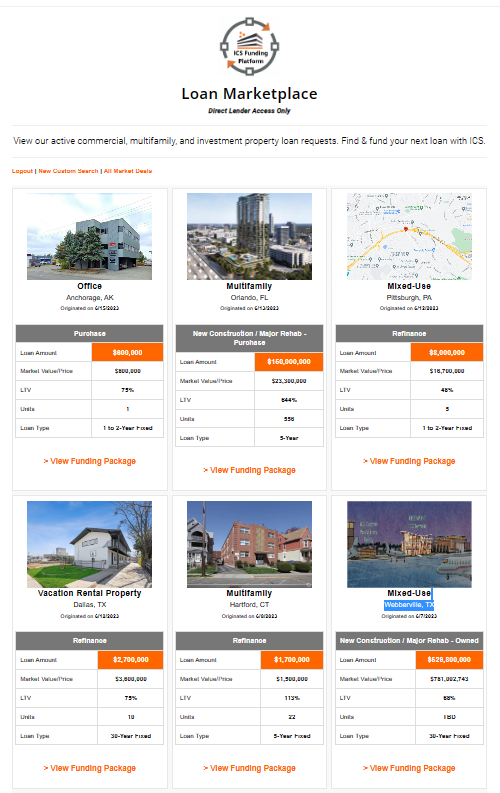

Arrange institutional and private capital for the acquisition, refinance, and construction of commercial, multifamily, and investment properties through ICS. Fund and close more deals, and keep 100% of your origination fees.

LEVERAGE THE POWER OF THE ICS LENDER NETWORK

FUNDING PLATFORM

Don't compete with Lenders. Make Lenders compete against each other to fund your loans.

Through the ICS Funding Platform you can structure, underwrite, price, package, and submit loans to our network of institutional and private Lenders for review. Interested Lenders will compete for your loans, offering their best rate and terms.

MORE LENDERS

MORE OPTIONS

#1 FUNDING PLATFORM

VERTICALLY INTEGRATED COMMERCIAL MORTGAGE LENDING

Hundreds of Loan Programs

Offer more loan programs through ICS.

STRUCTURE, PROCESS & PLACE YOUR LOANS TRHOUGH ICS

With ICS you have access to an expansive suite of institutional and private loan programs, tools, and resources, enabling you to provide a broad spectrum of loan solutions to your clients.

ASSET TYPES

You can arrange financing for all commercial, multifamily, and investment property types through ICS.

COMMISSION COMPENSATION

100%

Earn 100% of your loan origination points paid by the borrower at closing. Commissions are paid at closing or following closing depending upon the funding lender.

WHO WORKS WITH ICS?

ICS has hundreds of Lending Partners that submit loan requests for funding. We work with professionals across various industries.

Realtors

Residential Loan Officers

Independent Loan Brokers

Direct Lenders

Bankers

Financial Planners

Accountants

Sales Professionals

Marketing Specialists

THE ICS LENDER NETWORK

Through the ICS Funding Platform you can submit loan packages to our expansive network of Lenders that match the loan request requirements.

> View Lender List

JOIN ICS TODAY